Dr. Moira Somers is a Financial Psychologist. Her book Advice That Sticks (How to Give Financial Advice That People Will Follow) tackles the problem of unimplemented financial advice head-on. At first glance, it only appears relevant to people who are paid to give financial advice. However, Dr. Somers’ book is a resource for people working in all sorts of places, not just banks. Even high school teachers and former analysts who teach middle school students have been known to quote her!

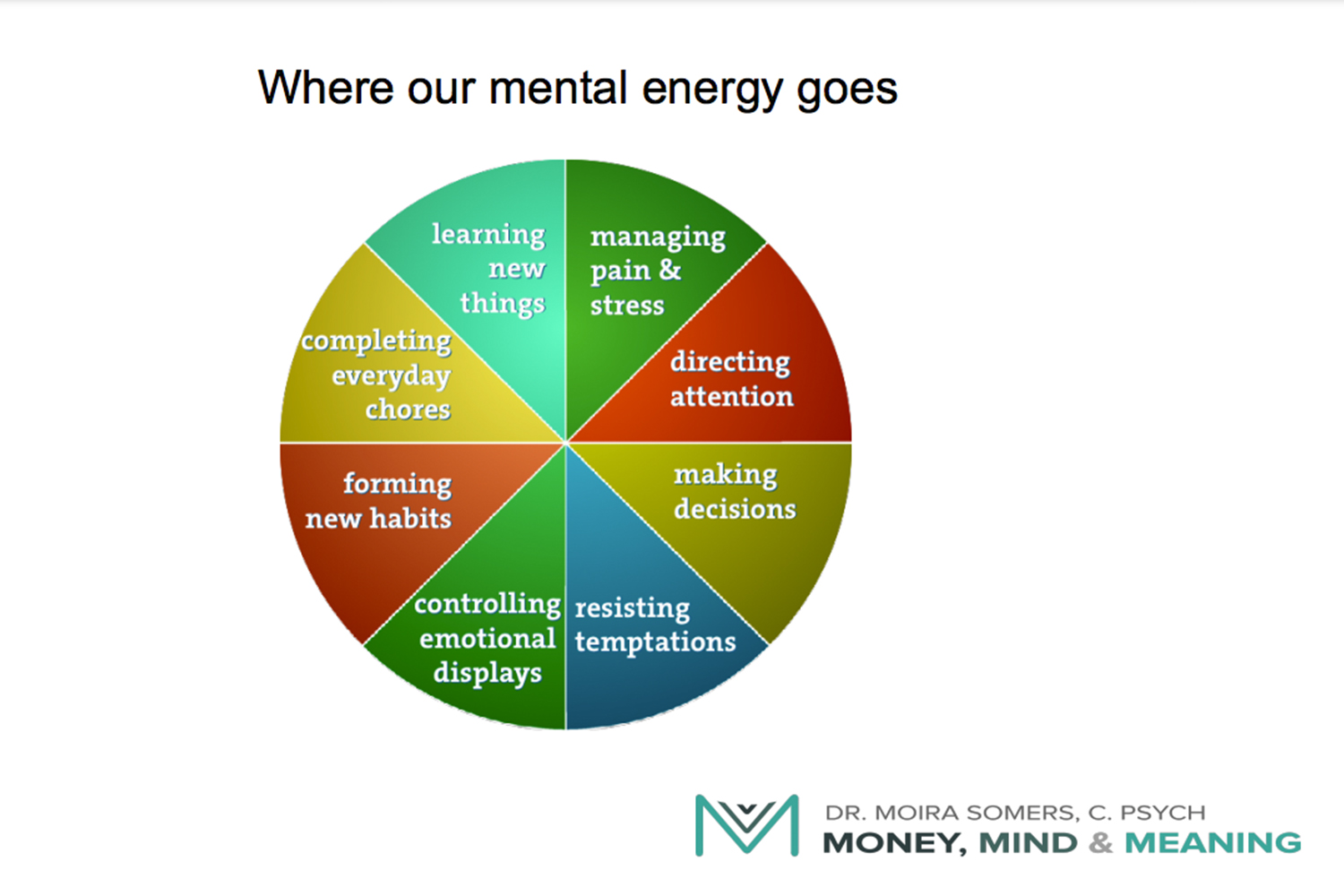

The broader appeal of financial psychology actually makes a lot of sense when you consider David Krueger’s famous statement that “the longest relationship most of us have is with money”. It begins before we are born in terms of the prenatal care our mothers receive and ends after we die via our funerals. “Advice That Sticks” is full of insights just like this one. Perhaps our favorite is Dr. Somers’ mental energy pie chart, which clearly illustrates the eight main places where mental energy goes. (Please do not reproduce the mental energy pie chart without the permission of Dr. Moira Somers.)

We use Dr. Somers’ mental energy pie chart to explain why thinking before buying is such an important skill and habit. As Dr. Somers states, mental energy is finite within a given time period. And exactly like a pie you’d serve for dessert, your mental energy pie doesn’t get bigger just because “more people are coming for dinner”. This is why stressful times are so stressful – you can’t help but “spend” more precious mental energy on the challenging area of your life – but the remaining areas don’t automatically demand less.

You know how it goes with kids…right in the most pressing stretch of your day, they’ll come to you with a “Dad, can I…buy these shoes…go to the game…?” Just think of all the precious mental energy that could be spared if children practiced the habit of thinking before buying. Families tell us every week that thinking before buying results in fewer, better-quality spending

Children who calculate the DIMS SCORE® for possible purchases avoid asking for things they may never actually use or appreciate. This is how thinking before buying helps young people economize on resisting temptations and controlling emotional displays. If you know you can assess whether or not you’ll really use and appreciate something before you buy it, FOMO (Fear Of Missing Out) isn’t that scary anymore. Is it?

We see kids change their minds about wish-list items all the time in our workshops. We also see them experience shock and awe when their parents quickly get behind a request that is “wrapped” in thought and advance planning. That pleasant surprise (the one kids experience when a parent says, “Sure!”) also gives credibility to the claim that thinking before buying does NOT mean that you never get to buy anything fun. All it means is that you plan your spending, avoid buyer’s remorse, and, just as importantly, avoid adding too many more “gently-used” articles of clothing or toys to landfills.

The final proof this book has something for everyone? How about the conclusion that genuine warmth is the first necessary precondition to creating an environment where “advice can stick”. Thanks for that, Dr. Somers. Thank you also for your recommendation that we read “Scarcity.” By taking the time to write to us, you quietly demonstrated not only your own beliefs but also Ezra Klein’s, which is that “…cooperation is humanity’s superpower”.

Click on the pink or blue buttons below to learn more about giving your children or students the habit of thinking before buying.

Financial Literacy For Parents For Teachers Inspiring Financial Writers