We always write in the third person at Gifting Sense. This post is the exception to that rule.

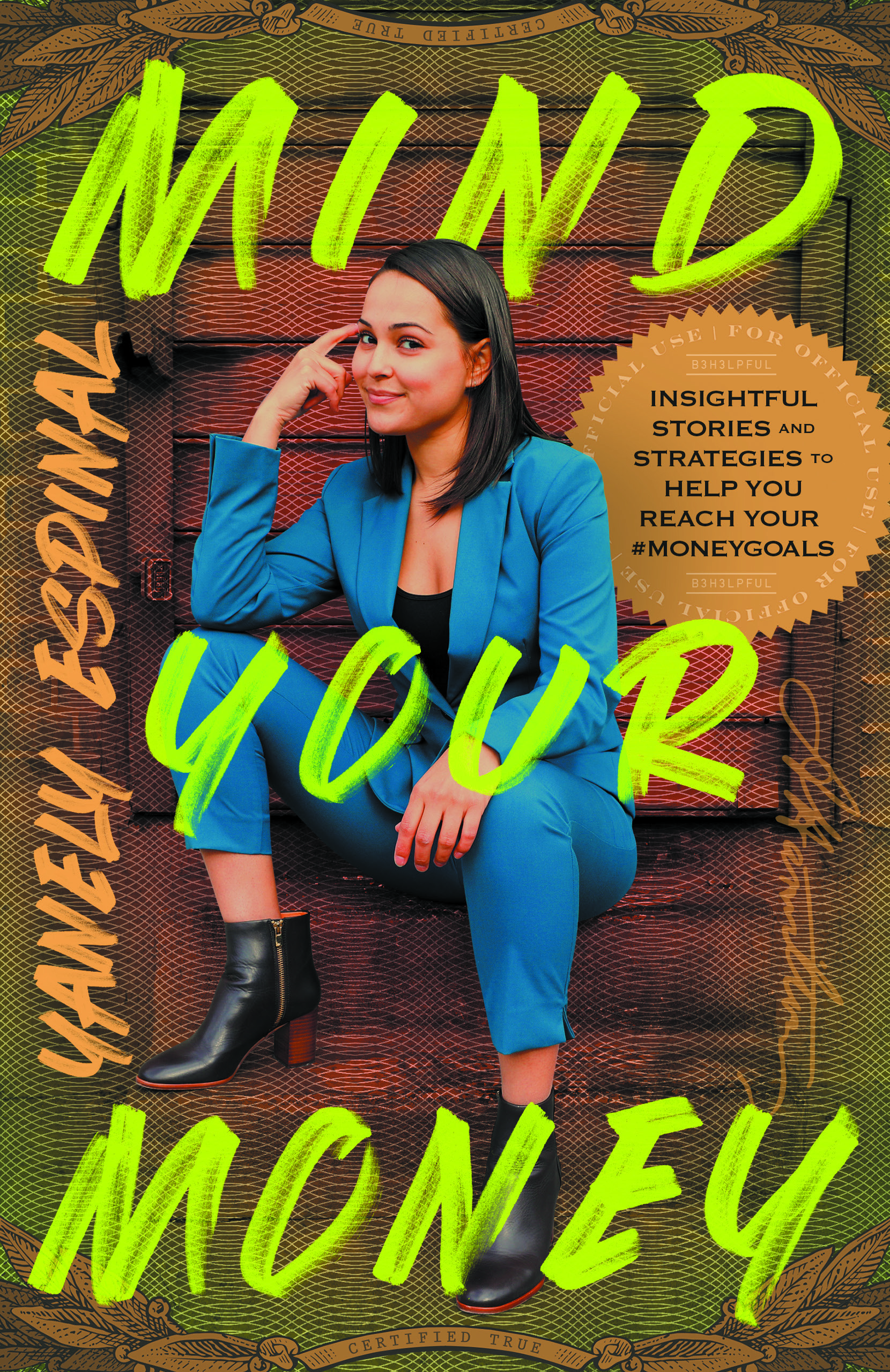

Yanely Espinal opens her new book “Mind Your Money” with the childhood story of when she first became aware of the fact that her family lived with scarcity. I have read and reviewed many personal finance books over the years. This is the one that made me recall my first memory of understanding – thanks to a comment from a middle school classmate – that my family lived with some sort of abundance. Up until that moment, I was just as unaware of the fact that my life wasn’t like every other kid’s as Yanely was.

I’m a lot older than Ms. Espinal and grew up in Canada. Hence, some of my college and early working year experiences were different just because University was then more affordable and credit cards were not as accessible. But I, too, made early adulthood personal finance mistakes. They included:

- Running up a big long-distance phone bill before Telecom was deregulated.

- Not shopping around for the very best car loan or mortgage rates.

- Not maxing out every single tax-advantaged or employer-sponsored savings program.

However, my parents had no language barrier; I grew up talking about money and was married shortly after graduating. So, with two (albeit small) incomes and no debt, my husband and I made our way. Almost thirty-five years later, squarely in the third act of my life, I’ve become a very passionate champion for early basic financial education – for all the reasons Yanely discusses in her book.

The book’s power…

“Mind Your Money” contains a lot of good information, including four unique discussions on:

- Why credit freezing can be a good idea.

- The importance of “negative visualization” to help you prepare for the failures/ lapses that life inevitably delivers.

- Why selling stocks during a “sale” market makes no sense.

- The difference between compound interest and compound returns.

But Ms. Espinal’s first-hand account of why “it’s much more difficult to dig yourself out of a hole than it is to avoid falling into one in the first place” is the book’s power.

Citing various experts and her own experiences growing up and getting herself out of $20,000 of credit card debt early in her career, Yanely explains why “teaching personal finance in schools helps level the playing field for all students, regardless of where they’re from or where they’re going.” All to say that if you need encouragement to request that your local school adopts personal finance workshops or classes, reading a copy of “Mind Your Money” will get the job done.

Don’t stop asking questions until you get to “Wow!” answers.

Yanely encourages her readers to keep asking “why questions” until they get to a “Wow!” answer. Here are some of mine:

- Children are more than capable of making well-thought-out consumer decisions when we give them a tool to help them quickly, but not arbitrarily, do exactly that.

- It is incredibly important to give young people a vision of how they can eventually live the life they want without spending more than they make before they become adult income earners.

- This will allow them to create an investable surplus to build an emergency fund (and then savings to invest in whatever they care about) when they become adult income earners.

So I couldn’t agree more, Ms. Espinal. “We need to stop shaming people for what they don’t know and instead demand financial education to improve what they do know.” Early financial education isn’t a silver bullet. It can’t solve every problem. But it can prevent many of them, especially the first-hand-experience type that thinking before buying delivers. Which is why I am forever stating that the habit of thinking before buying has to be one of the best gifts today’s school-aged children could ever get. If someone thinks they have a more powerful and accessible one, please let me know.

Karen Holland, Founder, GiftingSense.org

To learn more about the Gifting Sense “fun-damental” approach to early financial education, please click on the pink or blue buttons below.

For Parents For Teachers Inspiring Financial Writers